MCHS– The unfunded pension obligation in the state of Illinois is increasing.

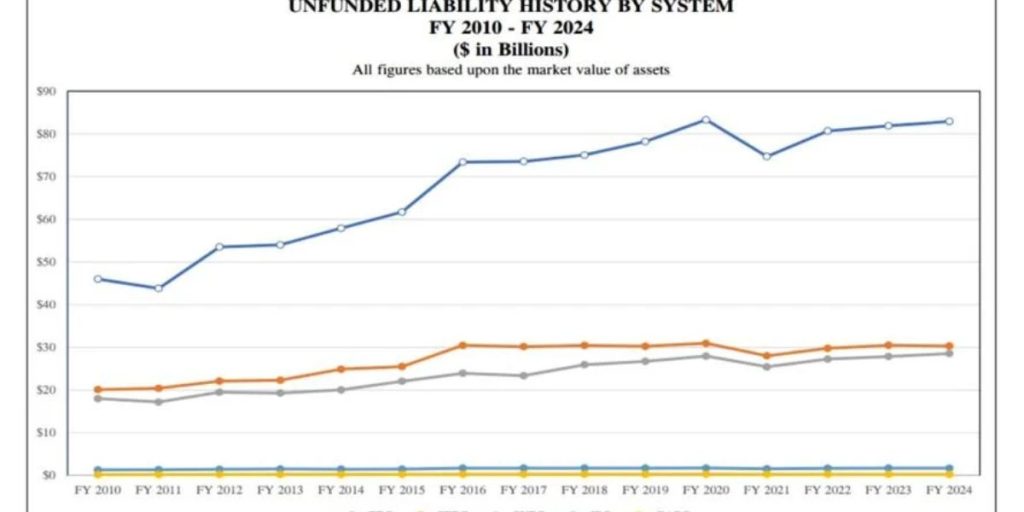

The Illinois Commission on Government Forecasting and Accountability reported that the most recent unfunded liability is $143.7 billion. That represents an increase of $1.5 billion compared to the previous year and the second-largest sum since 2020, when it reached $144.2 billion.

J.B. Pritzker, the governor of Illinois, stated on Wednesday that the state is making progress with regard to pensions.

“Our funded ratio for our pensions is much better today than it was when I took office and it continues to go in the right direction,” Pritzker said.

In 2019, the financing ratio was forty-three percent. 46% was the most recent funding ratio that was reached. Actuaries recommend a financing level of one hundred percent.

Ted Dabrowski, the President of Wirepoints, stated that even if the financial markets have reached all-time highs, this has not been sufficient to shore up the taxpayers’ expenses.

Dabrowski states, “That’s really the result of politicians having done zero to make things better for taxpayers.”

According to the COGFA, the annual cost to taxpayers is projected to increase from $11.2 billion this year to $18.5 billion by the year 2045. The unfunded obligation is anticipated to remain at approximately $144 billion until the year 2032, at which point it may decrease to $139.2 billion. This is because the funding ratio is continuing to grow. A financing ratio of 90 percent would result in the unfunded liability continuing to diminish until it reaches $34.2 billion by the year 2045.

According to Dabrowski, independent bond rating firms have determined that Illinois’ liability is far higher. According to him, the state government is not the only entity that is being negatively impacted by the inadequate pension policy; local governments are also increasing taxes in order to pay for local pensions, and the economy of the state is dependent on reform.

Must Read: Report: Average American Household Now Owes Over $10,000 in Credit Card Debt

On the other hand, he stated “But right now we don’t send any good signals to the public, we don’t send any good signals to the rest of the country as far as us being an economic growth engine because we refuse to touch pensions.”

The pension protection clause in the Illinois Constitution, which has been affirmed by the Illinois Supreme Court, safeguards the state’s pension system. In order to reduce costs, the pension system must be altered through a referendum of the voters.