A Kentucky state senator emphasizes that reducing the state’s income tax is their top priority.

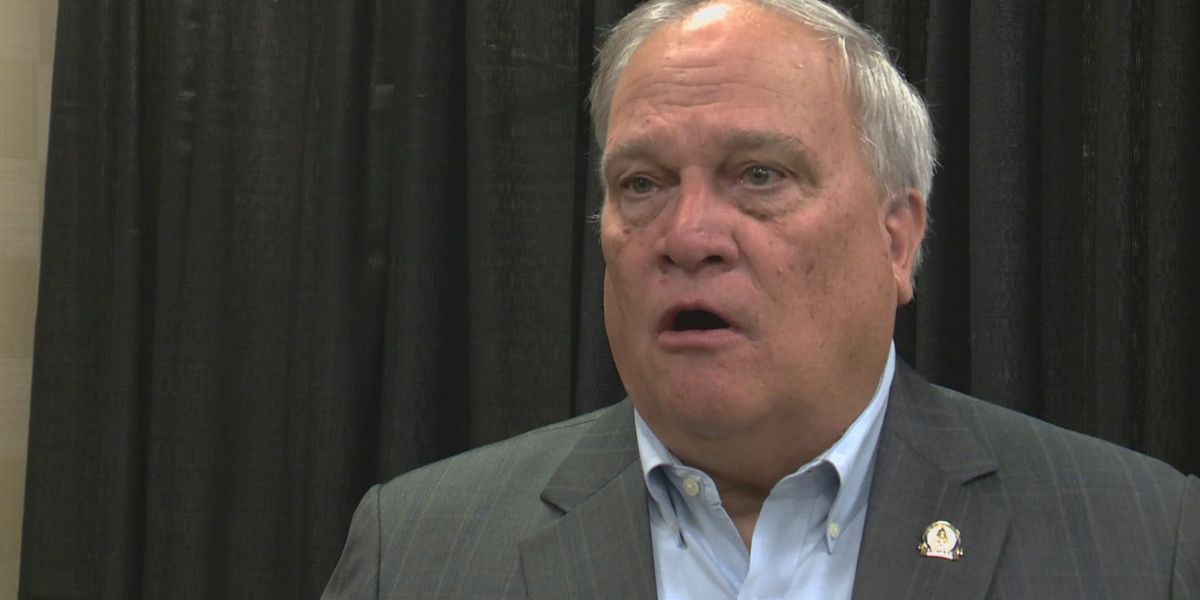

The President of the Kentucky Senate, Robert Stivers, is focusing on key priorities for the forthcoming legislative session in the state.

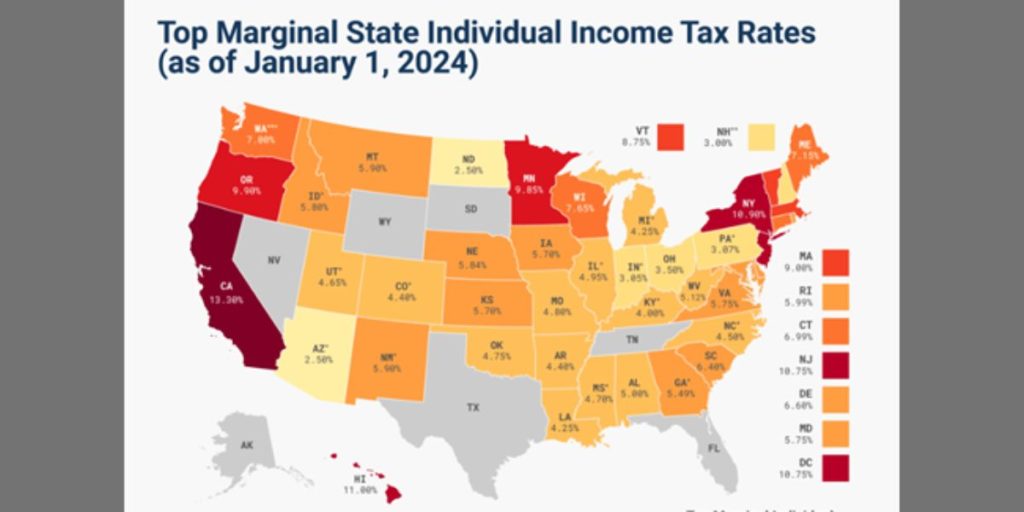

During the annual gathering at the Galt House on Saturday, Stivers addressed farmers regarding legislative matters. His top focus is to reduce Kentucky’s individual income tax from 4% to 3.5%.

This year, officials from Kentucky’s State Budget revealed that the state has fulfilled specific budget criteria, paving the way for a 0.5% reduction in the upcoming year.

In 2022, lawmakers from the Republican party approved a tax reform that lowers the individual income tax by 0.5% annually, contingent upon meeting specific budget criteria each year. Last year, it fell short of the required standard, but in 2024, it succeeded.

“We have guardrails on our tax code. We must have twice as much revenue coming in as what the tax cut would be so we will never get to the point in a tax cut that we will ever operate in the red, we will always be in the black,” Stivers said.

The Kentucky legislature is set to consider the tax cut when it meets in January.

Governor Andy Beshear has finalized the last tax reduction of 2023 and has expressed optimism about the potential for additional tax relief, referring to it as “good news.”

Following the defeat of Amendment 2 in November, Stivers indicated that the party is shifting its stance on educational options. Lawmakers are set to examine Kentucky’s public education framework more thoroughly.

Stivers highlighted a 9% increase they provided to the public education funding model, emphasizing their commitment to ensuring value for their investment.

“It’s going to be a system that we want to look at to see how we can get better outcomes,” he said.

Superintendents interviewed by WHAS11 News expressed that the funding allocated is insufficient to meet the salary increases they are seeking.

In order to match the starting salaries offered by Tennessee and Indiana, Hardin County Schools would have to increase salaries by over 9%.

At best, they might achieve 4% with the new state funding, while other counties may see even lower figures.

by

by